Dez Reads. TikTok's Financial Struggles, Tech's Political Tangles, The Final Curtain for 'Curb', Ad World's New Reality, Tesla's Tragic Lesson, and Beyond.

Welcome to this week's Dez Reads, where we dissect the nuanced dynamics of today's headlines and hidden stories. From TikTok's financial turmoil amidst potential U.S. bans to the political minefield tech companies navigate in Washington, we're covering the complex interplay of technology and governance. In entertainment, we reflect on the end of an era with "Curb Your Enthusiasm" and the evolving landscape of digital and physical advertising in our post-pandemic world. Plus, we delve into a tragic reminder of technology's fallibility with the story of Angela Chao's untimely death involving a Tesla.

Each narrative this week offers a gateway to understanding broader societal shifts, from the digital realm's growing pains to the personal impacts of our tech-saturated lives. Join us as we unravel these compelling stories, aiming to provide not just insights but a platform for deeper discussion on the forces sculpting our media and collective consciousness.

Here we go.

Finance.

The Information. TikTok Ban Spotlights Open Secret: App Loses Money

Much has been made of TikTok’s troubles in the US, with the House of Representatives taking (extremely rare) bipartisan action this week to force the sale or ban of the platform by a vote of 352 to 65. The key challenge for ByteDance, the platform’s parent company, is the downward pressure this action places on its valuation; it may not only be forced to sell but at a lower price due to the company’s lack of leverage.

Now we learn that the massively popular app isn’t even profitable. It has extremely high labor costs, and the cost of sales (i.e., hosting content) was $35 billion in the first three quarters of 2023; that is 41 percent of total revenue. By comparison, Meta spent $26 billion, or 19 percent of total revenue. TikTok is in a real bind here as bad news continues to pile up, reducing the platform’s valuation at the very time it may be forced to sell.

– Josh Culling

Entertainment.

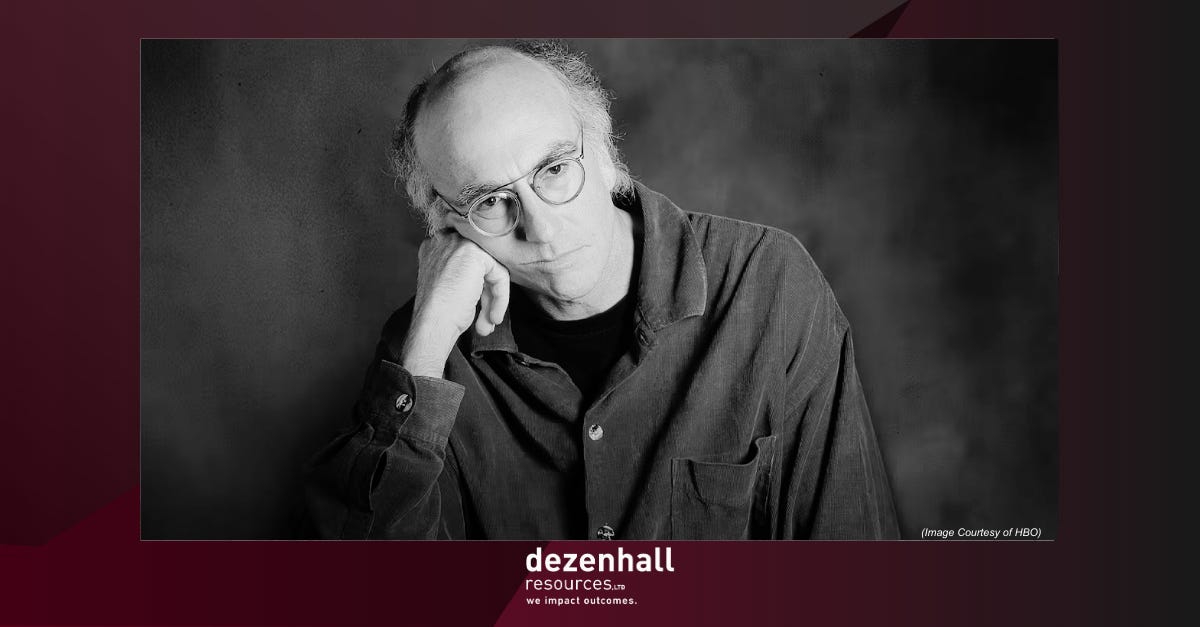

WSJ. ‘Curb’ Fans Are Pretty, Pretty Good at Unleashing Their Inner Larry David

It’s the final season of HBO’s Curb Your Enthusiasm, a show I love. I sometimes look online to see what the reviews of this and other shows are saying. There are increasingly granular, moment-by-moment analyses of programs. It must be hard to enjoy anything with this level of dissection. So much of the pleasure of entertainment is letting it wash over you. I think back to the early days of Curb, when I wandered into it. It moved slowly, and its creator and star, Larry David, ambled into social disasters. I’m glad there wasn’t much social media because, had I read through a Reddit colonoscopy, I don’t think I would have enjoyed a quarter-century of laughs.

There are occasional benefits to online entertainment discussions. Today, you can Google the lyrics to songs you like. As kids, we had no idea what singers were singing. This led to misheard lyrics (known as mondegreens) such as “There’s a bathroom on the right” for “There’s a bad moon on the rise” and “B-b-b-betting on the Jets” for “B-b-b-Benny and the Jets.” If Larry misheard the lyrics, I think it would be more fun to watch the horror unfold without the footnotes.

– Eric Dezenhall

Culture.

Adweek. The Out-of-Home Advertising Recovery Has Not Been Equal

When people were stuck in their homes during the pandemic, it’s no shocker that out-of-home advertising took a huge hit. It’s rebounded now and has been up 30 percent in revenue since then, but billboards are far outpacing retail in that recovery.

With 70 percent of people shopping online and 81 percent doing research online before buying something, it makes sense that ad dollars would shift even more from in-store to online advertisements. According to Statista, digital ad spending by retail companies is projected to be $84 billion in 2024, up from almost $30 billion in 2019, making it evident that advertisers want to put their dollars where customers spend most of their time.

However, I believe out-of-home advertising has more potential in a space where it’s far underutilized – public affairs and politics. With Americans seeing an average of 10,000 ads per day, it goes without saying that breaking through the noise is hard with a capital H. The most creative public affairs and political strategists can use memorable and unexpected out-of-home placements to ensure their message won’t get lost in the inundation of ads, both online and in real life.

– Annie Moore

Tech.

The Hill. TikTok hires another former Biden aide in push to avoid US ban

TikTok has been spending millions recently on ads, lobbying support, and advocacy to influence a congressional vote on legislation to ban or force the sale of the company to a non-Chinese entity. They lost the House vote 362 to 55. This follows decade-long trends of tech companies that get into the Washington influence game too late. We saw Microsoft give short shifts to DC during the 1980s as it was growing into one of the largest companies in the world. That changed when the Clinton Administration charged the company with anti-trust violations. We saw Apple, Facebook, Google, and others take the same approach… Waiting until things get bad and then acting.

There are a couple of reasons for this: 1) As fast-growing companies, they hate to throw money at offices that are pure expenditures, not profit-making. And they find the idea of giving money to politicians or having to explain themselves to 25-year-old legislative assistants distasteful. And 2) tech people, as well as many finance people we’ve worked with, have trouble reading the political tea leaves. They are too immersed in quantitative fields that don’t lend themselves to either interest or understanding of the political winds. I recall a meeting with a hedge fund CEO who was frustrated that key congressional leaders didn’t “understand” why a particular regulation wasn’t necessary. I had to tell him, “They do understand; they don’t care. The politics are against you.”

As TikTok is learning, too little and too late in the Washington influence game can be very costly.

– Steven Schlein

Human Interest.

WSJ. A Mistake in a Tesla and a Panicked Final Call: The Death of Angela Chao

There are more than 40,000 fatalities from car accidents every year. In 2024, unfortunately, Angela Chao, will be a part of that statistic. Curiously though, she was not struck by another vehicle. Rather, her malfunctioning Tesla Model X SUV essentially held her hostage, and she drowned in a stock pond within eyesight of her Texas home.

While turning around, Angela put her Tesla in reverse rather than drive, and the car sped backward, over an embankment, and into a pond. Though on the phone with friends on the property, as the car was sinking fast, because the Tesla’s doors and windows were electric, with particularly thick glass, there was no way out. What should have been a four-minute trip across her ranch cost Angela her life.

Angel’s death is a tragedy, full stop. However, most accidents don’t become Wall Street Journal profiles, so why are we here? As a successful and wealthy businesswoman who does business globally, is a philanthropist and is a mother, Angela is notable in her own right and garners national media attention. As the wife of Jim Breyer, billionaire venture capitalist, sister to former Secretary of Transportation Elaine Chao, and sister-in-law to Senator Mitch McConnell (who cited Angela’s death as part of the reason he’s stepping down from his leadership post), this curious case was of interest to one, but nine, WSJ staff.

Though other automakers have entered the EV scene, and Elon Musk has become a divisive figure, Tesla remains the 100 lbs. gorilla in the marketplace and in the hearts of luxury car buyers. It’s not just a car; it’s a status symbol that shows that its owners care about the environment and are on the cutting edge of technology. Interestingly, sources close to the family say no one blames Telsa, and Breyer considers Elon Musk a friend. I think I would feel very differently if Angela were my friend or family member.

Angela knew exactly what was happening to her in her last moments. I cannot imagine a more terrifying way to leave the world, and I cannot help but wonder: are we being trapped by technology, both figuratively and literally?

– Anne Marie Malecha

Dezenhall Resources is a leading consultancy specializing in high-stakes crisis management and strategic communication. With decades of experience, our firm is adept at navigating complex, controversial issues for a diverse clientele, including Fortune 500 companies, high-profile individuals, and non-profit organizations